working capital funding strategies

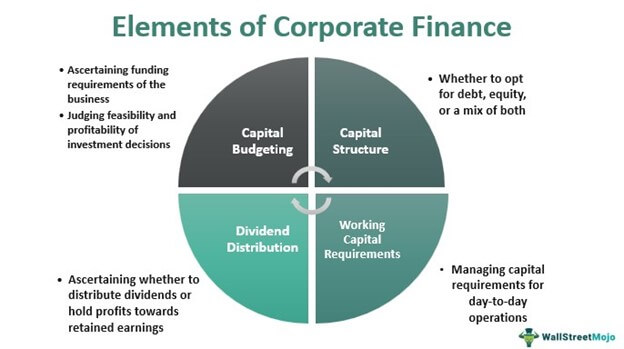

Working capital finance is funding designed to improve cash flow and liquidity. Funding gap Developing vendor strategies that incorporate the funding cost of inventory and enable flexible financing solutions will help to better balance supplier and retailer cash priorities.

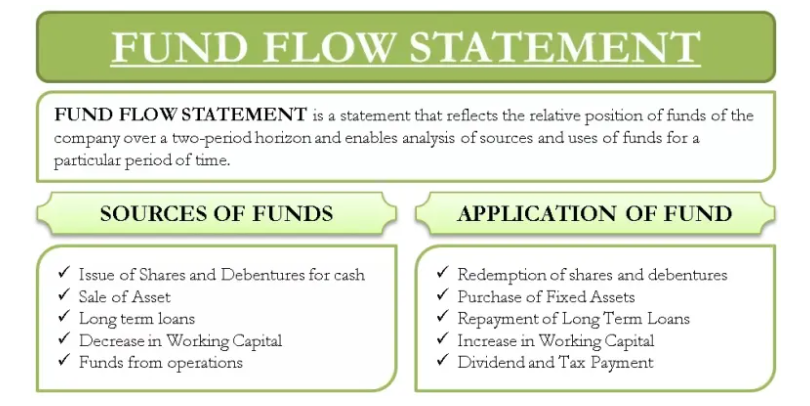

What Is A Fund Flow Statement Uses Benefits Explained

Often the cheapest option but qualifying can be difficult and a line increase can be even harder if you dont have suitable financial statements or additional collateral.

. Use a credit card. B Describe and discuss the key factors in determining working capital funding strategies including. Your working capital position can always be improved by earning higher profits issuing company stock taking on more debt and selling assets for cash.

Its primarily used to free up capital so a business can meet short and medium-term commitments and continue to grow. A conservative strategy suggests not to take any risk in working capital management and to. Working capital is the difference between a.

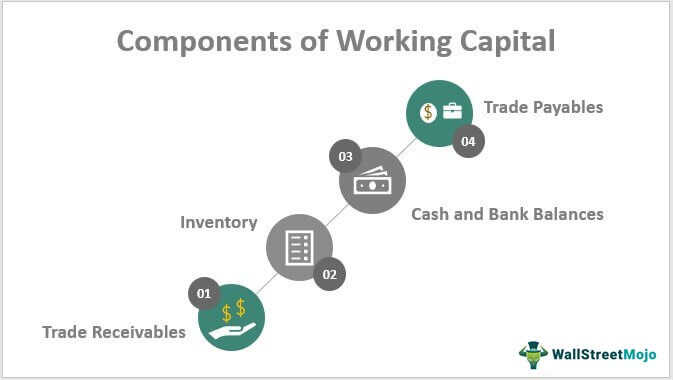

13 Elements of working capital. Funding gap metrics can be established by vendor product family or even SKU. 6 Strategies for funding working capital.

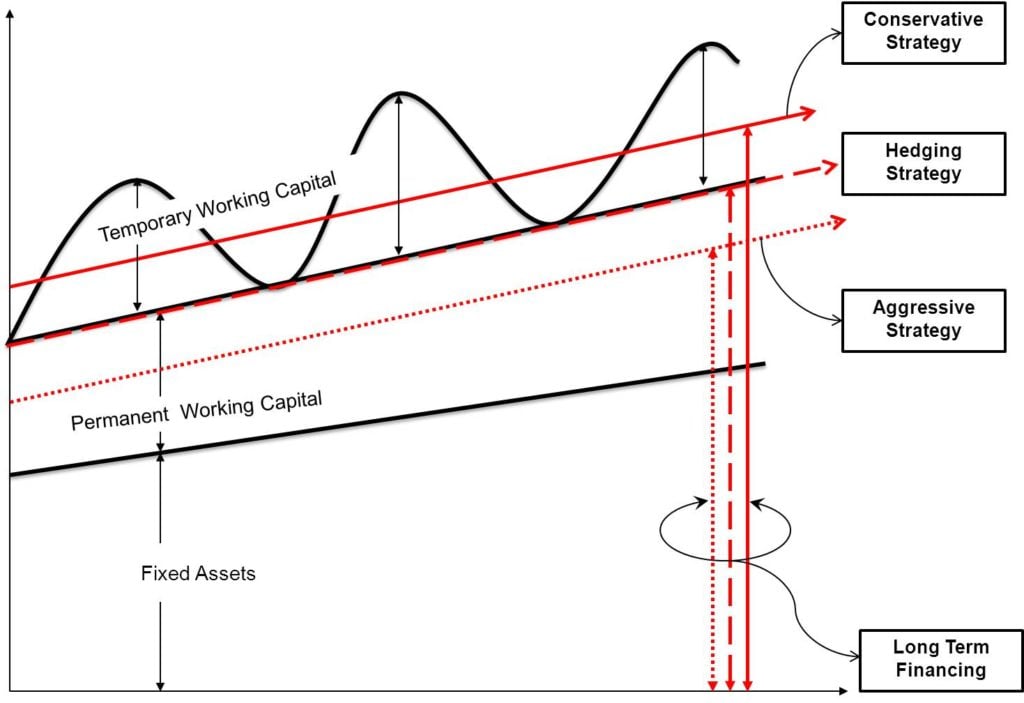

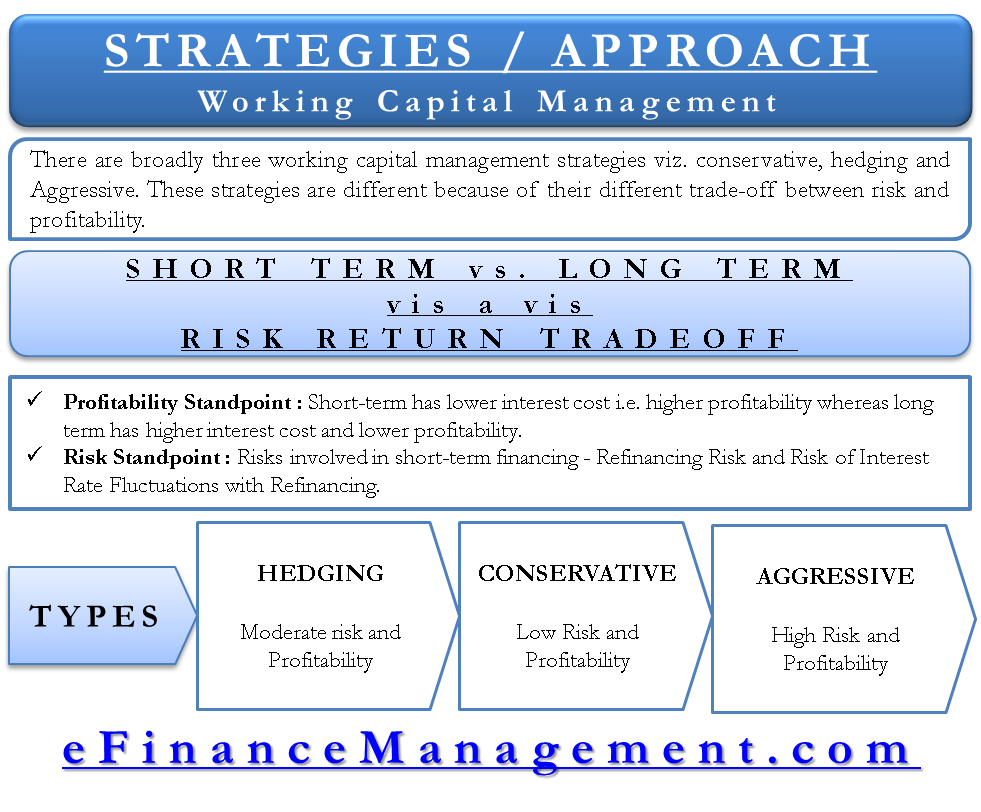

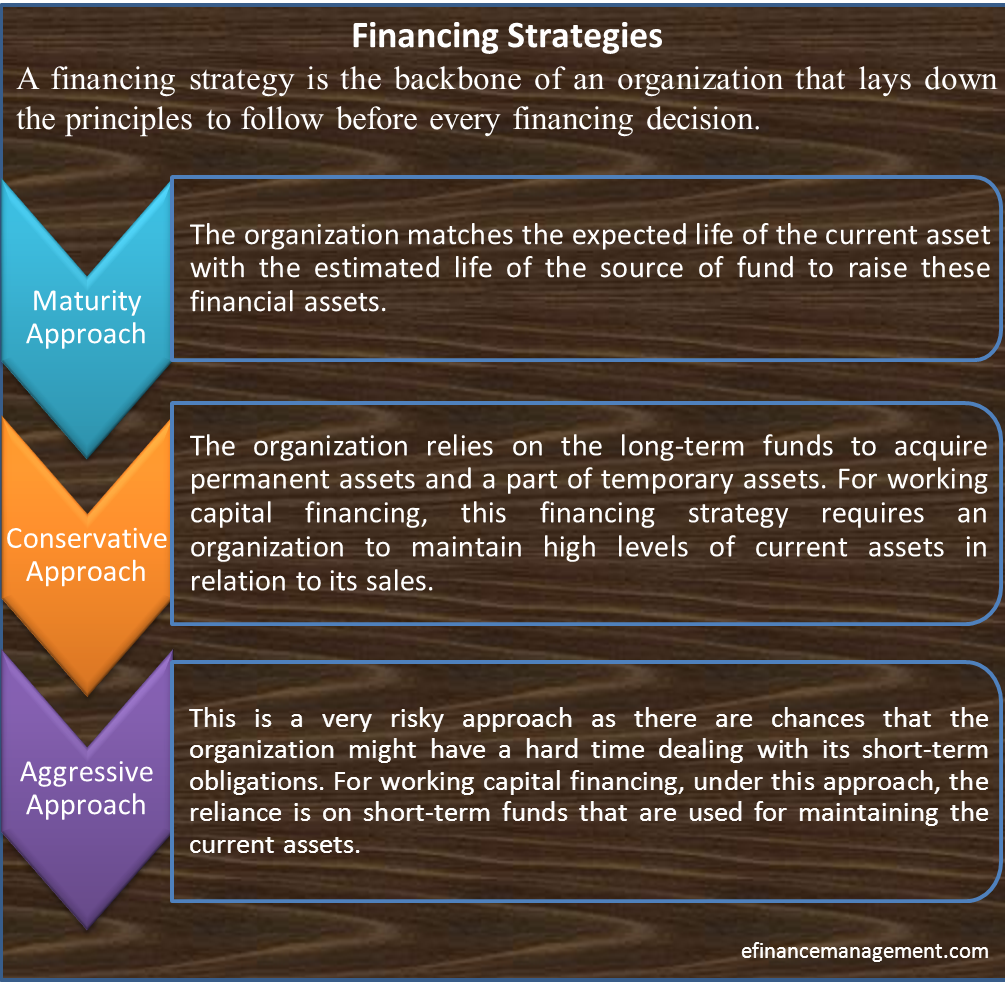

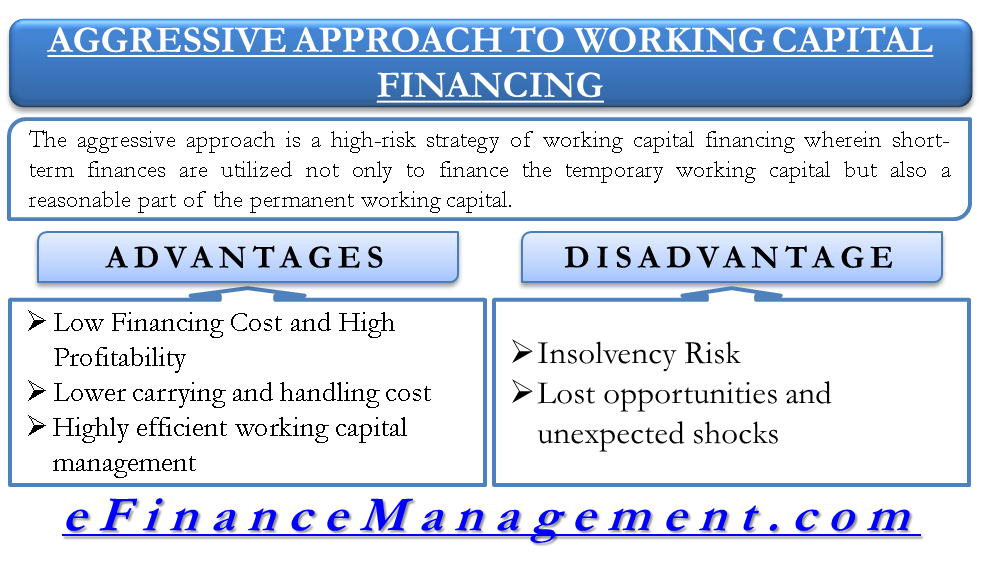

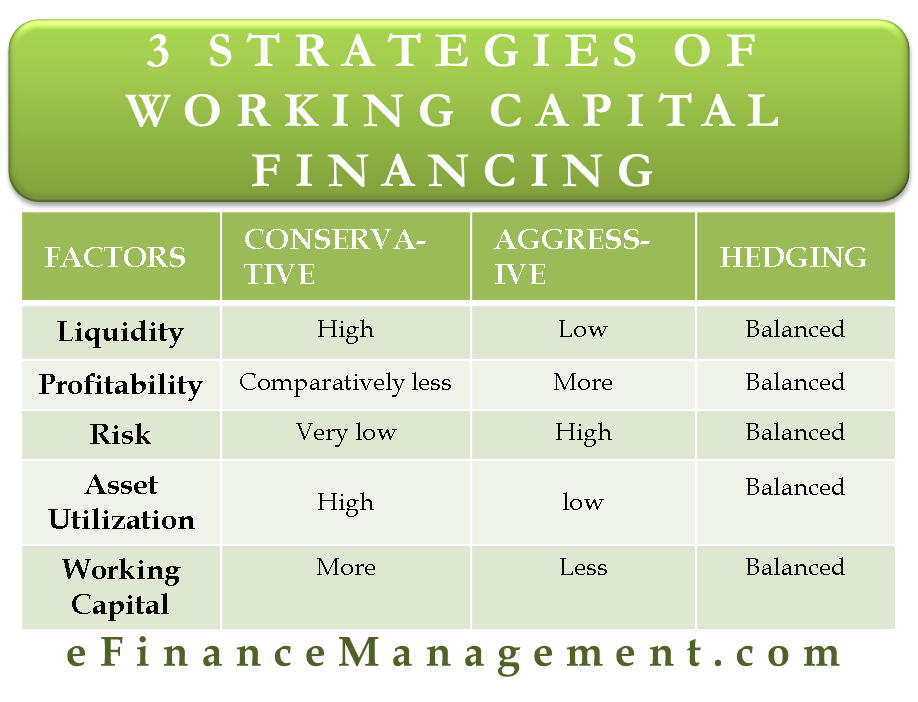

Conservative This is the least risky method of capital management. Typically youll have longer term loans with. Aggressive conservative and matching funding policies.

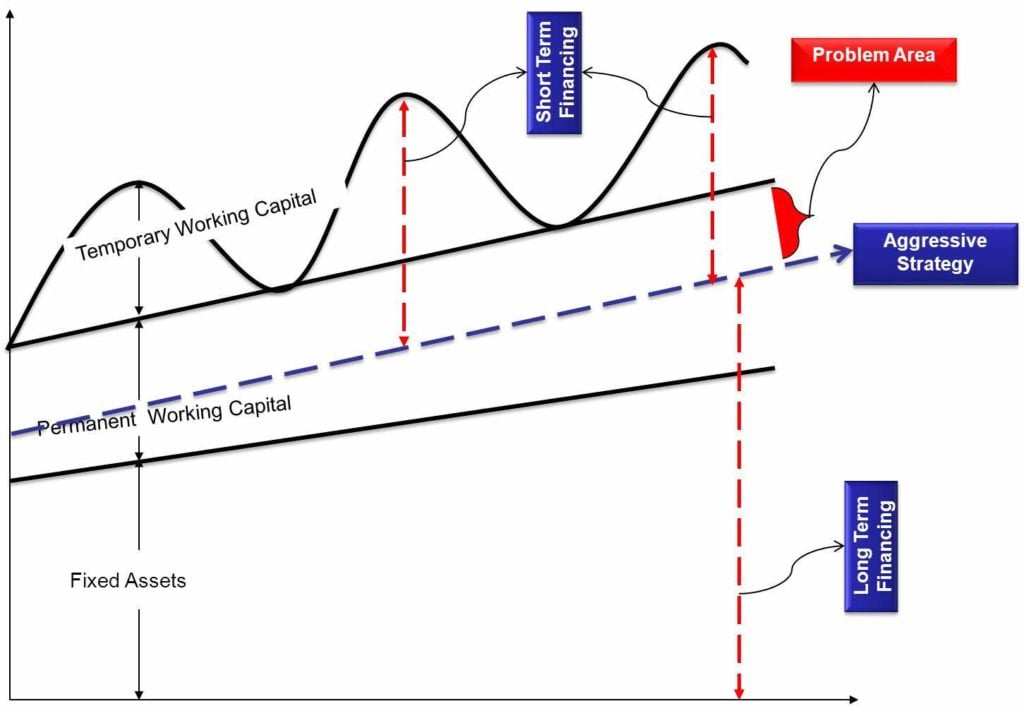

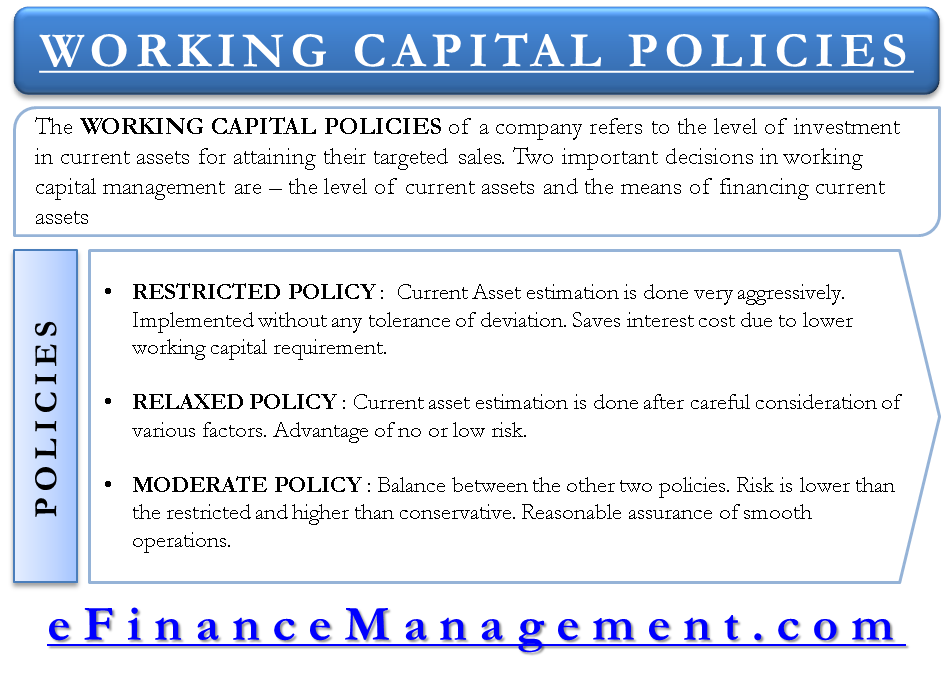

We are living in a Volatile Uncertain. Conservative Approach As the name speaks for itself this strategy finances working capital with low risk and profitability. Explain the main strategies available for the funding of working capital explain the distinction between permanent and fluctuating current assets explain the relative costs and risks of short-term and long-term finance explain the logic behind matching short-.

Broadly three strategies can help optimise working capital financing for a business namely hedging aggressive and conservative as per the risk levels involved. 122 Calculation of the cash operating cycle. Get a revolving line of credit from a bank.

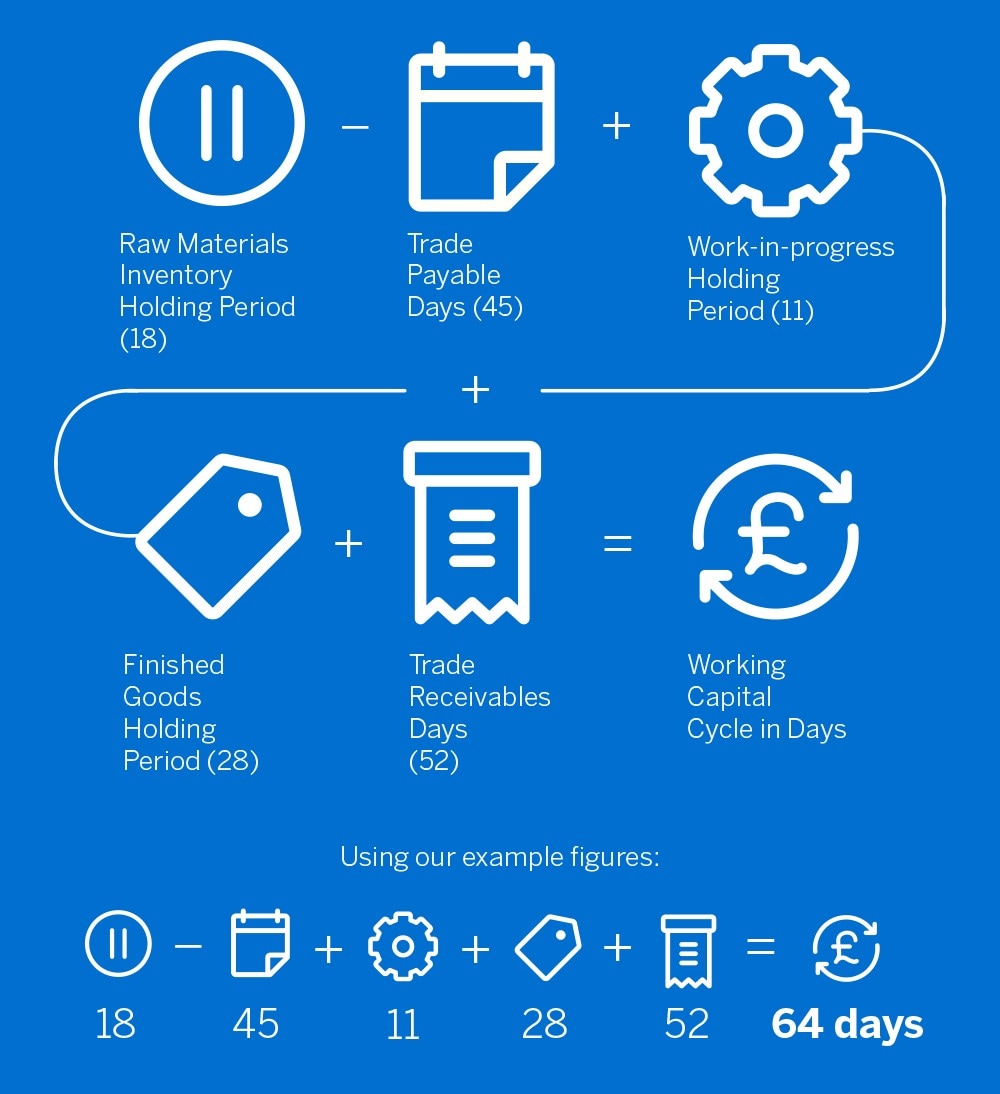

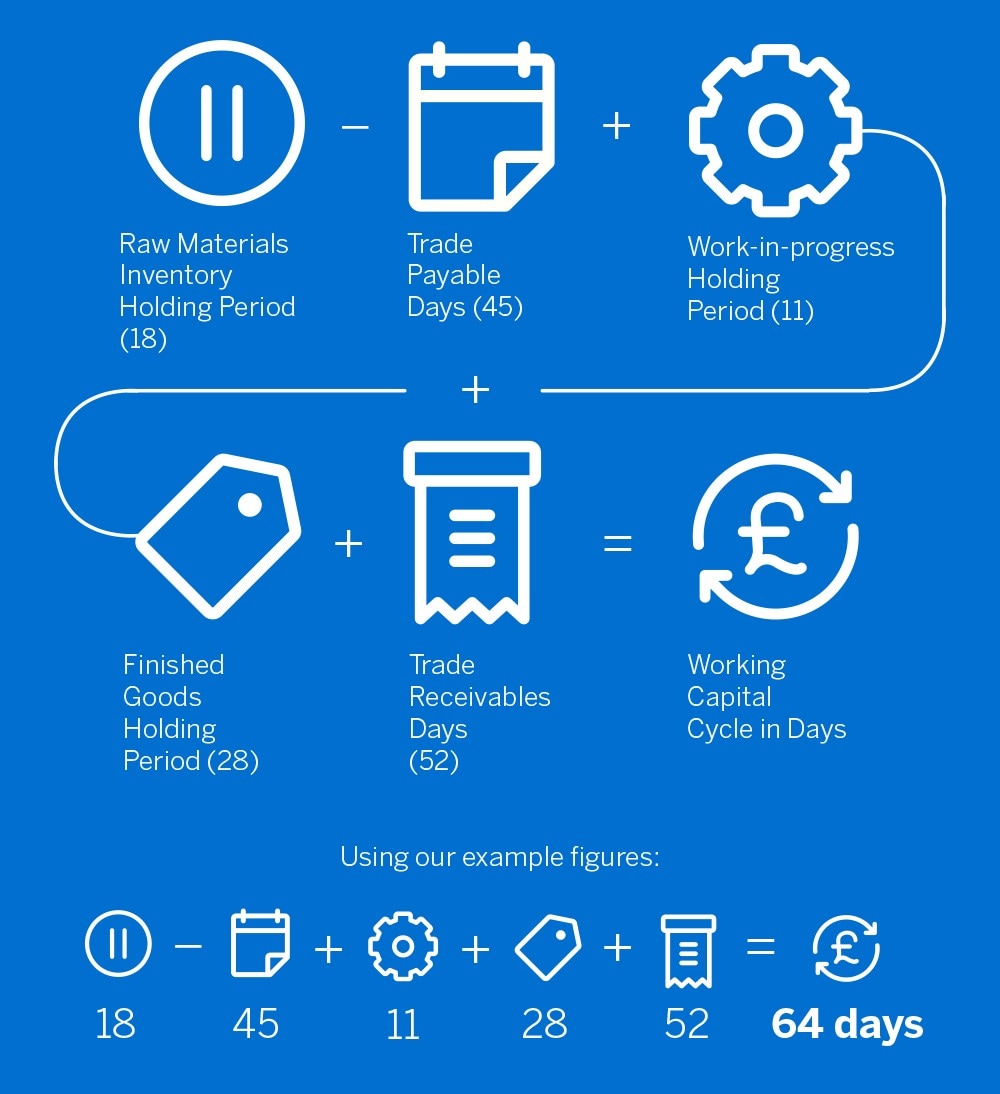

121 The elements of the operating cycle. Imagine Scenarios and How Your Company Might Navigate Through Those. 112 The attitude of management to risk.

Below are three working capital strategies businesses should adapt based on their credit score industry business size working capital turnover ratio and financial goals. 12 The cash operating cycle. Give your organization a new framework to optimize working capital and digitize payments.

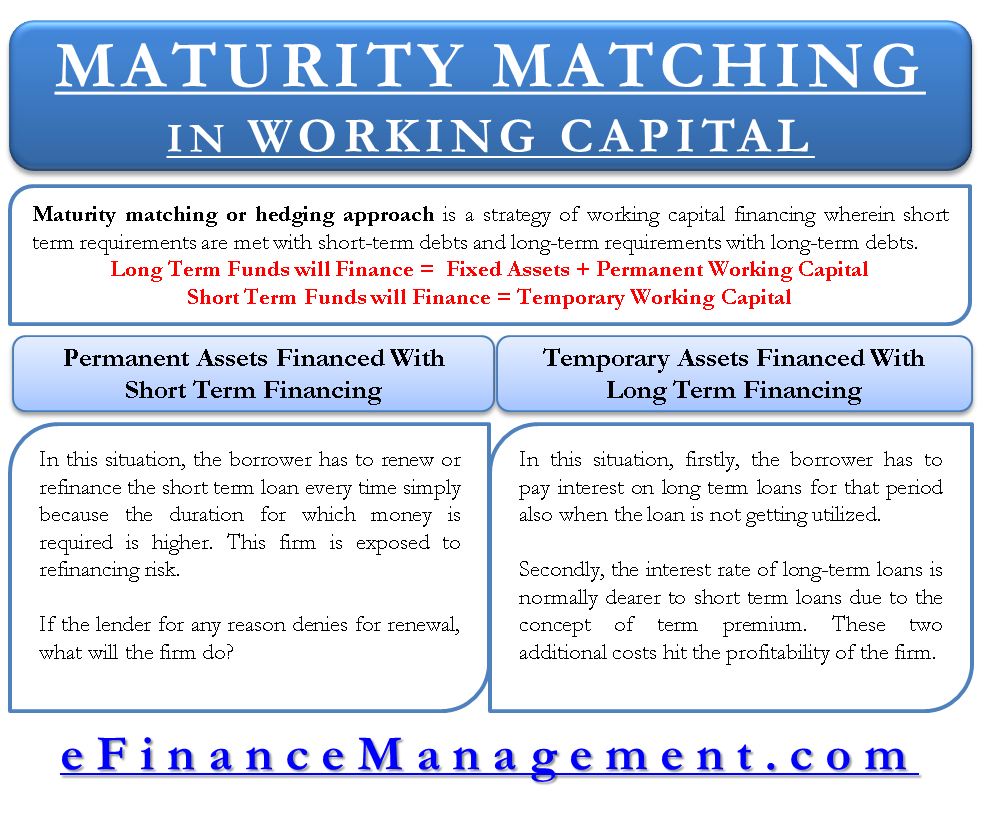

Use a credit card. There are three different styles of working capital management lets look at them now. Hedging In this concept the loan terms will nearly match when the asset is maturing.

Use a credit card. Working Capital Management Strategies. 122 Calculation of the cash operating cycle.

Strategies to Manage Working Capital Different elements of working capital such as bills receivable cash inventory etc need to be taken care of in order to manage working capital of a business. Conservative Policy An organisation undertakes this strategy only. Working Capital Management Strategies 1.

Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. 6 Strategies for funding working capital. Under this approach current assets are maintained just to meet the current liabilities without.

111 Permanent or fluctuating current assets. You can use working capital financing to cover overheads during a cash flow gap or fuel growth if you need funding to capitalise on an opportunity. Explain the main strategies available for the funding of working capital explain the distinction between permanent and fluctuating current assets explain the relative costs and risks of short-term and long-term finance explain the logic behind matching short-.

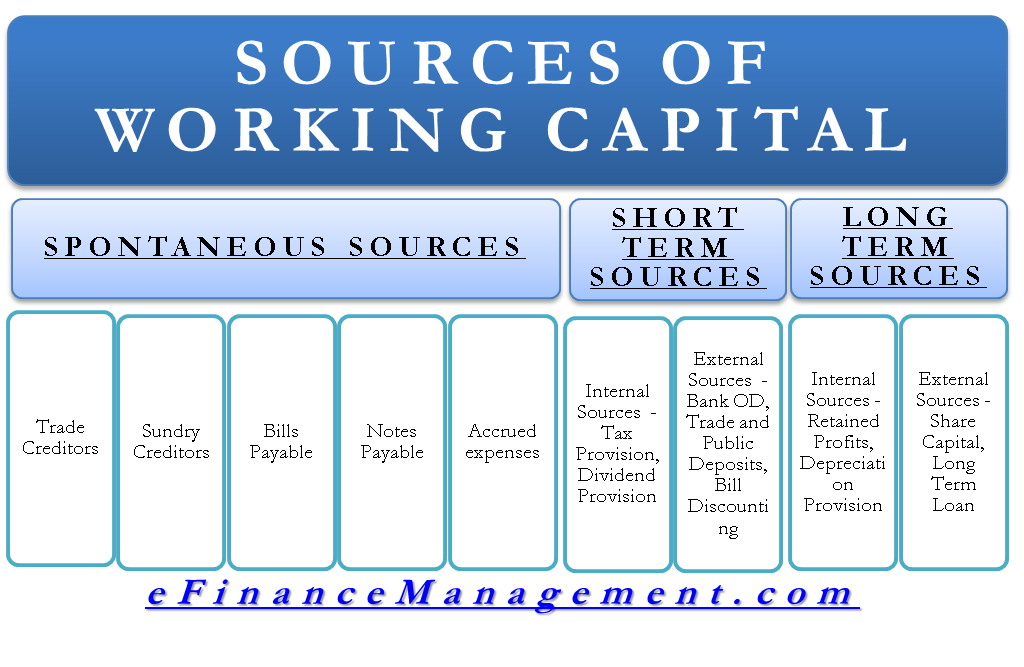

Lets understand how each of these components are managed individually to have an optimum level of working capital. Therefore funds are required in order to run day-to-day operations of the business. 3 Strategies of Working Capital Financing.

There are three strategies or approaches or methods of working capital financing Maturity Matching Hedging Conservative and Aggressive. Finding Ways to Boost your Business Working Capital. The first step in building a successful working capital management plan.

How to Plan an Effective Working Capital Management Strategy Analyze Current and Future Funding Requirements. I the distinction between permanent and fluctuating current assets ii the relative cost and risk of short term and long-term finance iii the matching principle.

Real Estate Private Equity Career Guide

Working Capital Management Strategies Approaches

Working Capital Cycle What Is It With Calculation

Working Capital Optimization Through Payment Terms

Working Capital Management Strategies Approaches

Constructing A Capital Budget Ag Decision Maker

Growth Equity Primer Expansion Capital Investment Strategy

Cheat Sheet For Raising Capital For Business Start Up Startup Funding Startup Infographic Raising Capital

Working Capital Cycle What Is It With Calculation

Financing Strategies Matching Conservative Aggressive Approach

Aggressive Approach To Working Capital Financing Management Efm

Aggressive Approach To Working Capital Financing Management Efm

10 Funding Options To Raise Startup Capital For Business

Compare 3 Strategies Of Working Capital Financing

Components Of Working Capital Top 4 Detailed Explained

Working Capital Policy Relaxed Restricted And Moderate

Corporate Finance Definition Principles Examples Types

Spontaneous Sources Of Working Capital Finance

Maturity Matching Or Hedging Approach Rationale Pros Cons Example