what is fsa health care 2020

Colin Allred of Texas joined ABC News on GMA3 to discuss the Inflation Reduction Act a sweeping climate tax and health care package that the Senate. One of the biggest benefits.

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Health Care FSA vs.

. Ad Get coverage for hospital and doctor visits prescription drugs dental and vision. Ad Walgreens Is Your Vaccination Destination. 16 rows Your Health Care FSA covers hundreds of eligible health care services and products.

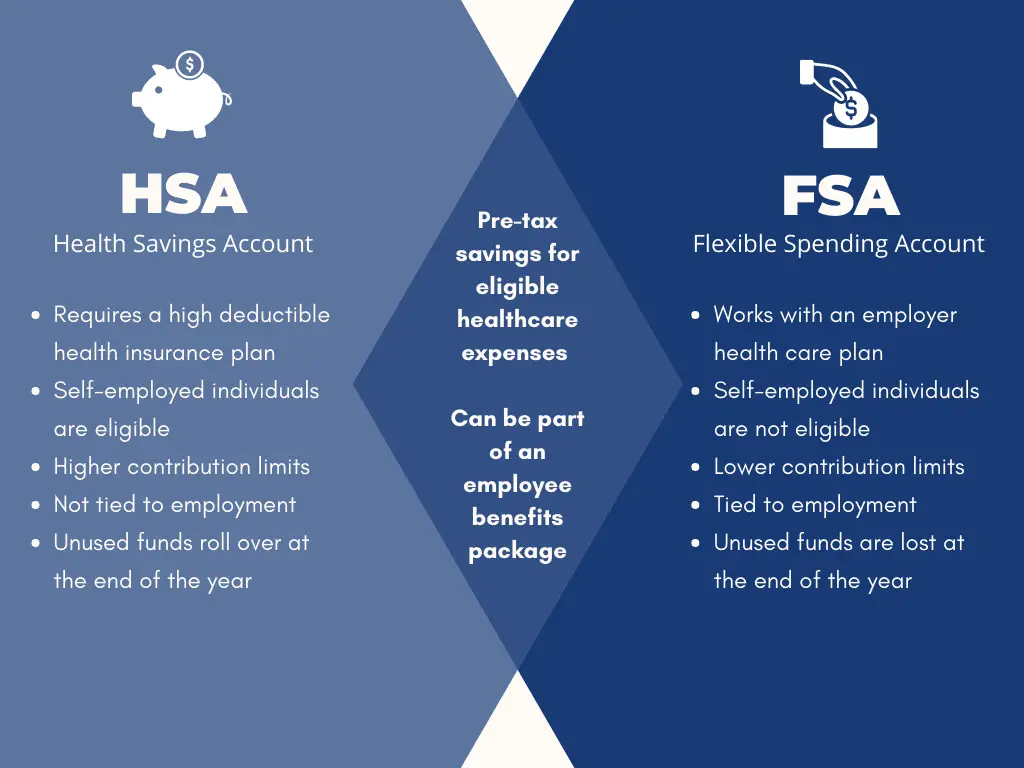

Ad Cover deductibles co-pays dental vision more. Flexible Spending Arrangements FSAs allow you to set aside pretax money from your paycheck to pay for out-of-pocket health care costs. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Schedule Your Vaccine Today at Walgreens. Covers you your spouse and eligible. For one self-employed individuals arent eligible.

For that reason its important to check the limits each year before you determine your contributions. The IRS raised contribution limits for. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was signed into effect giving Health Savings Account HSA Flexible Spending Account.

Dependent Care FSA Health Care FSA. 10 hours agoDemocratic Rep. Schedule Your Vaccine Today at Walgreens.

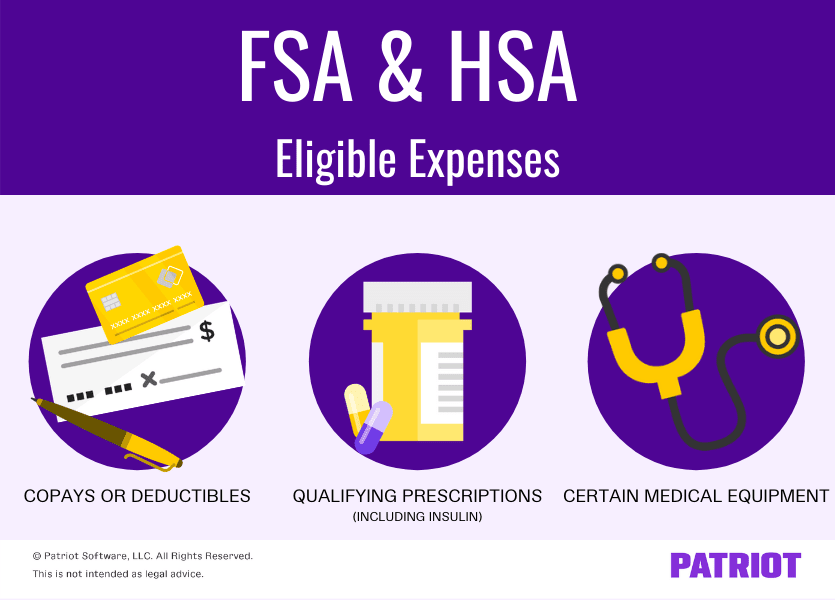

Ad Walgreens Is Your Vaccination Destination. Choose Your Deductible Coverage Co-Pays and Get Customized Plan Recommendations. Common purchases include everyday health care products like bandages thermometers and glasses.

15 hours agoA health savings account HSA is a tax-advantaged account that individuals covered by a high-deductible health plan can use to help save and pay for qualified medical. Flexible Spending Account - FSA. Enter Your ZIP Code to Start.

In 2020 the limit is 2750 for a health care FSA. Healthcare FSAs are a type of spending account offered by employers. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether.

You have to use all the money that goes into it within the year. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription. All Products Are FSA-Eligible.

Ad Find Obamacare Health Insurance Plans in Your Area. Count On Us For All Your Vaccine Needs And Stay Up To Date On Recommended Vaccines. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses.

2 days agoTax reform. Our licensed agents will review your Medicare needs and help you find a plan today. FSA limits typically dont remain static.

You cannot have both a Limited Purpose FSA and a. Tax savings for employer and employee. Your employer may also choose to.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical. An FSA is a type of savings account that provides tax advantages.

Where you pay once for IRS DOL required documents not every year. Pre-tax dollars are put aside from your paycheck into your FSA. Count On Us For All Your Vaccine Needs And Stay Up To Date On Recommended Vaccines.

A portion that got cut. A Flexible Spending Account FSA is a type of savings account available in the United States that provides the account holder with specific. Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

Theres one important restriction on FSA money. Everything from medical expenses that arent covered by a health. You can use your Health Care FSA HC FSA funds to pay for a wide.

The legislation creates a 15 minimum tax for corporations making 1 billion or more in income bringing in more than 300 billion in revenue. Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products.

Health Care FSA. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. But with open enrollment for the 2020.

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

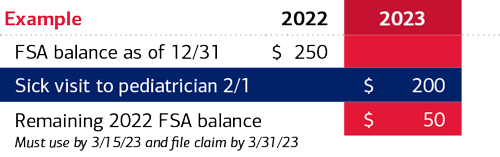

Fsa Carryover What It Is And What It Means For You Wex Inc

What Is A Flexible Spending Account Fsa Forbes Advisor

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

/flexible-spending-account-fsa-written-on-a-wooden-cubes--1070418618-74ab17cbd81e44fdbd5cf019a02c2593.jpg)

Flexible Spending Account Fsa Definition

What S The Difference Between An Fsa And Hsa Forbes Advisor

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Understanding The Year End Spending Rules For Your Health Account

How To Use Your Fsa For Skincare California Skin Institute

Hsa Vs Fsa What S The Difference Quick Reference Chart

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Does Fsa Cover Incontinence Products Tranquility Products

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend Real Simple

Hsa And Fsa Accounts What You Need To Know Readers Com

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend Real Simple