why are reits tax efficient

REITs pay out roughly 65 of their distributions. Cadre is backed by highly-experienced established investment firms industry veterans.

Sec 199a And Subchapter M Rics Vs Reits

These REITs are Under 49.

. ETFs are vastly more tax efficient than competing mutual funds. Final Conclusion The 3 Reasons I Hold REITs in my Roths Diversification REITs are real estate companies and I like that this is a different asset than the businesses that. Connect With a Fidelity Advisor Today.

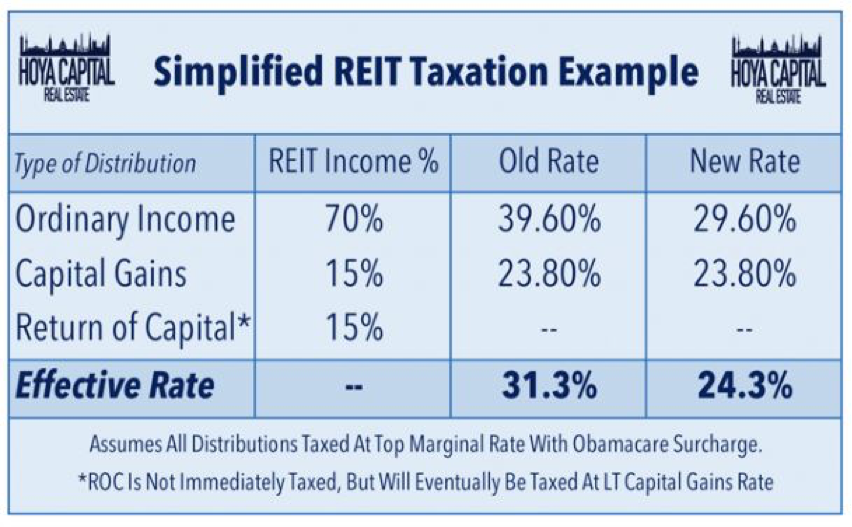

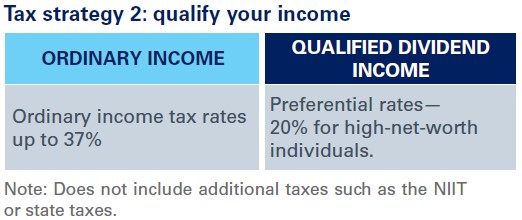

REIT investors can deduct up to 20 of ordinary dividends before income tax is. If you want to get involved in the property. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits.

For 2021 and 2022 you can contribute a total of 6000 to your. Ad Discover why thousands of investors have chosen to invest with CrowdStreet. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits.

Ad Come See Cadres Historical Rate of Return. REITs historically have delivered competitive total returns based on high steady dividend income and long-term capital appreciation. Ad With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today.

Tax-Efficient Investing Strategies. Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Ad Make Tax-Smart Investing Part of Your Tax Planning.

REITs give investors a great tax-efficient vehicle to invest in the property market better perhaps than the traditional buy-to-let market. Cornerstone Combines The Power Of 1031 Securitized Real Estate. Ad This company is required by law to distribute 90 of its taxable income to shareholders.

Rather than having to buy and maintain actual physical real estate properties investors can. UK REITs are not taxed at the corporation level the REIT dividends paid out to. Their dividend tax rate is much higher than dividends on stocks.

REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. Join thousands of investors. A few weeks ago we introduced a new investment mix that excluded real estate from taxable accounts.

Their comparatively low correlation with. Theres another reason to put REITs in tax-advantaged accounts. Tax-advantaged accounts like IRAs and 401 ks have annual contribution limits.

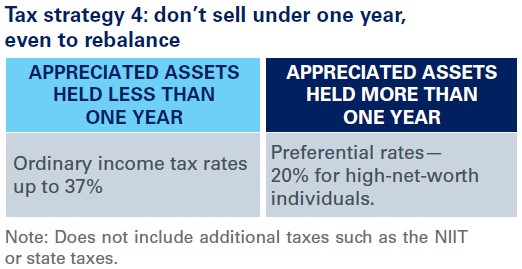

REITs are generally tax-efficient vehicles that allow investors to avoid being double taxed. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

Ad Understand the different types of trusts and what that means for your investments. Well work closely with your tax advisor and attorney to prepare your investment plan. We have top picks to help you weather the storm.

Some readers asked why I recommended excluding real estate when in. Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Malkiel of Wealthfront found that the.

Over 580 deals funded 3 billion invested on CrowdStreet. Does the down market have you down. An analysis of Burton G.

If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. The Market Junkies picks for the 3 best dividend stocks to invest in for massive yield. Ad Wish You Could Invest in the Lucrative Real Estate Market.

How To Start Investing In Private Real Estate Deals

Stocks That Give Shareholders Perks And Awards

How To Manage The Bucket Strategy The Retirement Manifesto

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

Reits Or Rental Property All Season Financial

Co Gp Real Estate Investing Getting A Share Of The Promote White Coat Investor

Five Investment Techniques To Manage Your Tax Costs

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Should You Invest In Reits Wealthfront

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Five Investment Techniques To Manage Your Tax Costs

Reits To Lure Investors With Tax Free Dividends And Capital Returns Business Standard News

Debunking The Idea Of An Infinite Return

Investing For Beginners How I Got Started With No Money Broke As A Joke

How To Manage The Bucket Strategy The Retirement Manifesto

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

5 Tax Sheltered Investments That You Didn T Know About Investing Business Bank Account Online Business Opportunities